Seismic change underway in market

Oplo research shows a “New Mainstream” of customer emerging often ignored by traditional lenders

“New Mainstream” often financially excluded from obtaining credit

Leading UK consumer lender Oplo releases an important new report today Read report (PDF) which reveals that the market’s traditional way of viewing customer profiles in terms of lending criteria is rapidly becoming outdated.

Consumer credit is a key feature of everyday life for the vast majority of Brits, with over 80% of adults (42.5million) using a form of regulated credit in the past 12 months*.

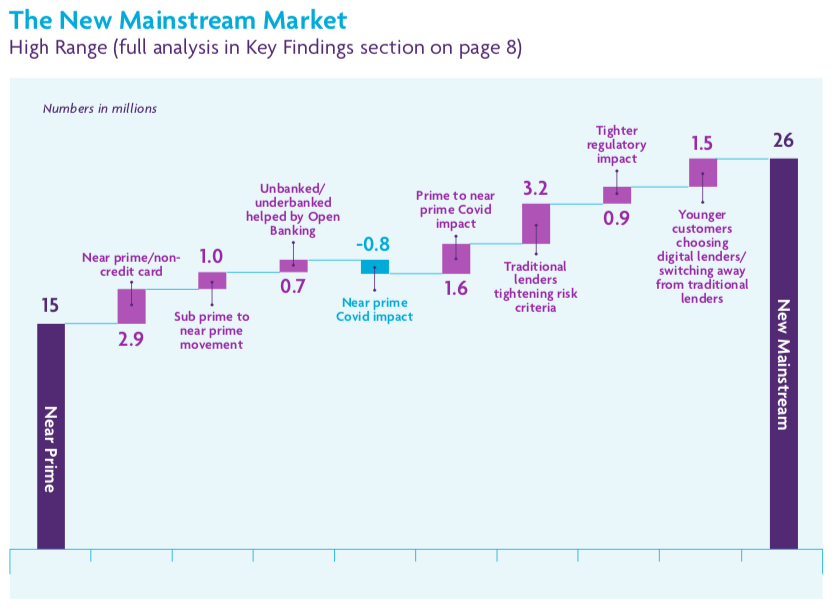

Traditionally, the consumer credit market has been viewed through three main categories of consumer: prime, near-prime and sub-prime. Oplo’s report reveals this segmentation does not account for some powerful underlying changes taking place including the effects of the introduction of new policy and technologies to a wide range of long-term industry and consumer trends.

This has resulted in a new category of consumer: The New Mainstream, which the report shows now constitutes a market of some 26 million borrowers.

The ‘New Mainstream’ category is a cohort of British consumers straddling both the traditional prime and near-prime categories who are often unable to access credit due to traditional lenders increasingly tightening their lending criteria.

Oplo’s analysis of the market shows that:

- The impact of Covid is likely to see over 1.5 million consumers move from prime to ‘near prime’ credit segments

- The tightening of risk criteria by Britain’s traditional bank lenders is likely to see a further 3 million customers move from prime to near prime categories

- While at the same time an additional 1.5 million young customers are thought to have moved away from choosing traditional lenders for borrowing and opting to use digital and alternative lenders for their personal borrowing

Alex Mollart, Oplo’s CEO, said:

“In many ways, the UK has a highly competitive and innovative consumer credit market but we don’t see due consideration by traditional lenders to people’s circumstances and potential. In today’s world, people’s lifestyles and financial circumstances fluctuate considerably, which often means that they are denied access to the best offers available as they don’t fit neatly into a “prime” or “super-prime” customer segment.

“This is a very one-dimensional view and instead we believe that the power of a customer’s potential should be recognised.”

Oplo’s New Mainstream Report provides detailed analysis of the UK’s consumer lending market and explores the contributing factors to changes we are seeing in how this market is evaluated and understood – from macro-economic trends, industry trends, changing lifestyles and consumer preferences. The report can be downloaded <>.

ends

Media enquiries:

corporateaffairs@myoplo.co.uk

Notes to Editors:

*Financial Lifes Survey, FCA, February 2020

About Oplo:

- Oplo is one of the UK’s leading providers of consumer credit, offering personal loans, home loans and car finance to the emerging “new mainstream” market of consumers seeking credit.

- Oplo makes it easier for people to access fair, expert lending with excellent personalised customer service powered by modern, innovative technology.

- Oplo has over £300m assets under management and is on-track to realise its ambition of becoming the largest direct-to-consumer lender of its type in the UK.